The cash flow statement in the financial statements will show net cash transactions in each category for that specific time period, which is helpful for business owners to track trends to ensure the company is moving from a startup phase to a growth-stage or later-stage company. Cash generated from profitable operations can be used to repay debt and pay dividends to shareholders. In later-stage companies, it is normal to see positive operating cash flows, neutral investing cash flows and negative financing cash flows. However, the company will likely not be repaying substantial amounts as it should be using this money to reinvest in the business. Financing will likely be neutral as the company will require fewer injections of cash to stay afloat now that it is generating cash from operations. These investments will likely be to a lesser extent than during the startup phase, as many earlier investments should still be used and beneficial to the company. The company will start generating some income and will use the resulting cash to continue investing in assets for the future of the company. Growth-stage companies and cash flowĪt the growth stage, it is normal to see positive operating cash flows, negative investing cash flows and neutral financing cash flows. There likely will be a few years of operating losses resulting in negative cash flows while the company has expenses but little revenue. The startup will be obtaining financing cash to start the business and will be using these funds to make investments for the future of the business. Paying off debts and paying shareholders are shown as negative transactions.ĭuring the startup phase of a business, it is normal to see negative operating cash flows, negative investing cash flows and positive financing cash flows. Incurring debt and receiving contributions are shown as positive transactions.

This refers to money received as debt or equity (e.g., bank loans, capital contributions from shareholders). Positive cash flows are divestments of, or sale of, these assets. Negative cash flows are investments in, or purchases of, these assets. This refers to cash spent on items to be used over multiple years to increase efficiency or profitability for the business (e.g., equipment, technology and investments in business relationships or joint ventures).

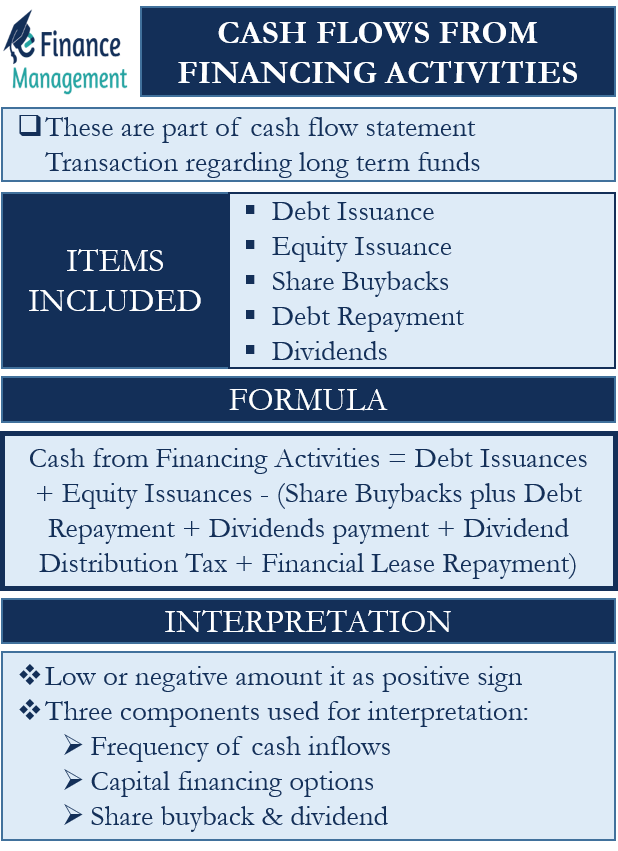

This refers to the net cash received in the form of revenue from sales or service, less cash spent on expenses of running the business. Operations: Cash flows from operations.Cash transactions: Operations, investing and financingĪll cash transactions―cash in (receipts) and cash out (disbursements)―fall into three categories: o perations, investing and financing. Cash flows stem from operations, investing and financing activities. For this reason, you need to manage your cash flow to ensure that you get the maximum benefit out of it to grow your business. When facing multiple demands for limited cash, there are three key considerations (interest rates, penalties and borrowing covenants)-avert the worst scenario first.Ĭash is the lifeblood of any business and is always in short supply.The cash flow statement in the financial statements helps you see whether the company is growing.Cash flow stems from operations, investing and financing activities, and normally moves from negative to positive as you grow past the startup phase.Cash flow is critical to a business so you must manage your cash flow wisely.

0 kommentar(er)

0 kommentar(er)