- TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO

- TEXAS AG EXEMPTION LAND REQUIREMENTS REGISTRATION

- TEXAS AG EXEMPTION LAND REQUIREMENTS PROFESSIONAL

Applying on PaperĪ paper application is a slower way to apply. There are 2 ways you can do this following these tips below.Īpplications typically take place between January to April of the year corresponding to your application.

TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO

How to Apply for the Ag Exemptionįinally, if you believe you meet all the criteria to qualify, then you’ll be ready to submit your application.

TEXAS AG EXEMPTION LAND REQUIREMENTS PROFESSIONAL

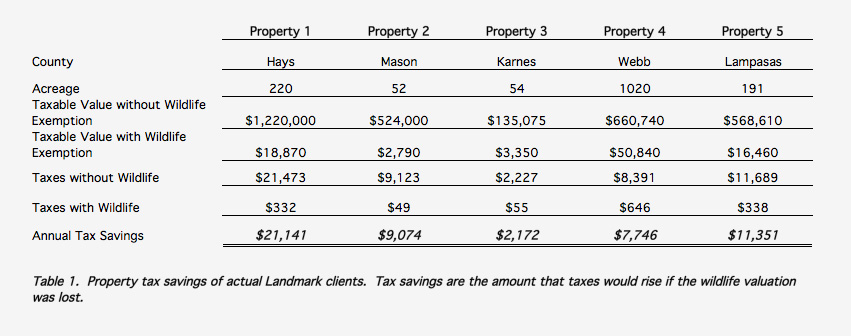

Of course, the process may seem complicated in the beginning, and you may want to consider engaging professional accountants or to ask your local county clerk to assist you along the way. Generally, if your tax rate is high, you can expect savings at well over 50% as your land is re-evaluated based on farmland purpose.Īs such, it may be worth applying for an ag exemption. the type of agriculture you are engaged in.

Your potential tax savings will depend on several factors, including: Thus, many farmers may begin to wonder if it’s even worth the hassle. Is It worth Applying for the Ag Exemption?įor many small-scale farmers in Texas, applying for an ag exemption may feel like a hassle, as you’ll have to go through various leaps and bounds to qualify. It’s also worth noting that this list is non-exhaustive and may be subject to change. If you have registered your business with the Texas Secretary of State, you may also have to provide your SOS file number to qualify for an ag exemption. This number must be issued by a valid comptroller to certify that you can be exempted from taxes imposed by the county.

TEXAS AG EXEMPTION LAND REQUIREMENTS REGISTRATION

you sell eggs or meat for a profit and you have obtained the necessary permits from the relevant authorities. The question is: do keeping chickens qualify me for the ag exemption? You may well qualify depending on the number of hens and their use.Ĭhickens may be eligible for the Ag exemption, provided they can genuinely be considered an integral part of an agricultural business. This exemption allows you to be placed under a different valuation method and consequently enjoy tax savings.Īs is common for tax schemes, you will have to meet certain conditions, like having to own a certain number of acres or a designated number of animal units to qualify for the exemption. If you live in Texas or you’re considering starting a new life in Texas, you may have heard of the ag exemption that could save you some coin.

0 kommentar(er)

0 kommentar(er)